- Geta - Connecting Innovation and Investors

- Posts

- Idea to IPO

Idea to IPO

Grassroots Grind or Investor Gold Rush?

Grassroots Grind or Investor Gold Rush?🚀

Ever dreamt of transforming your ingenious idea into a billion-dollar behemoth? The journey to an Initial Public Offering (IPO) can be exhilarating, but fuelled by more than just fairy dust and ramen noodles. While bootstrapping – funding your startup with your own grit and hustle – has its allure, it's not the only path to entrepreneurial nirvana.

This blog post unpacks the pros and cons of each approach, empowering you to make an informed decision for your unique startup journey.

Bootstrapping: Building on Your Own Foundation

Bootstrapping is like building a house brick by brick. You rely on personal savings, revenue generation, and potentially small loans to finance your startup's initial operations and growth. This approach have some pros:

🔐 Maintaining Control: You, the founder, make the final decisions, ensuring your vision remains at the forefront.

🚀 Flexibility and Agility: Without the pressure of investor expectations, you can adapt your strategies and pivot quicker as needed.

🏆 A Sense of Accomplishment: Building a successful startup with bootstrapping brings immense satisfaction and a sense of ownership.

However, bootstrapping also comes with cons:

Slower Growth: Limited capital can restrict your ability to hire top talent, invest in marketing, and scale operations rapidly.

Financial Strain: Personal finances can become stretched, impacting your personal life and potentially causing stress.

Venture Capital: Fueling Growth with External Investment

Venture capital firms are like rocket fuel for startups. They provide significant financial backing in exchange for equity in your company. This translates to faster growth potential, but also comes with strings attached:

📈 Rapid Growth: VC firms often expect aggressive expansion and high returns on their investment.

🪁 Loss of Control: Investors may have a say in major decisions, potentially impacting your original vision.

🤯 Increased Pressure: Meeting investor expectations and delivering results can be stressful.

Choosing Your Path: Aligning Funding with Your Goals

The ideal funding strategy hinges on your specific startup's goals and risk tolerance. Here are some factors to consider:

Growth Trajectory: Do you envision explosive growth, or are you comfortable with a more gradual, organic pace?

Control Preferences: How comfortable are you relinquishing some control over decision-making?

Risk Tolerance: Are you prepared for the potential financial strain of bootstrapping, or do you prefer the security of VC funding (with its own set of risks)?

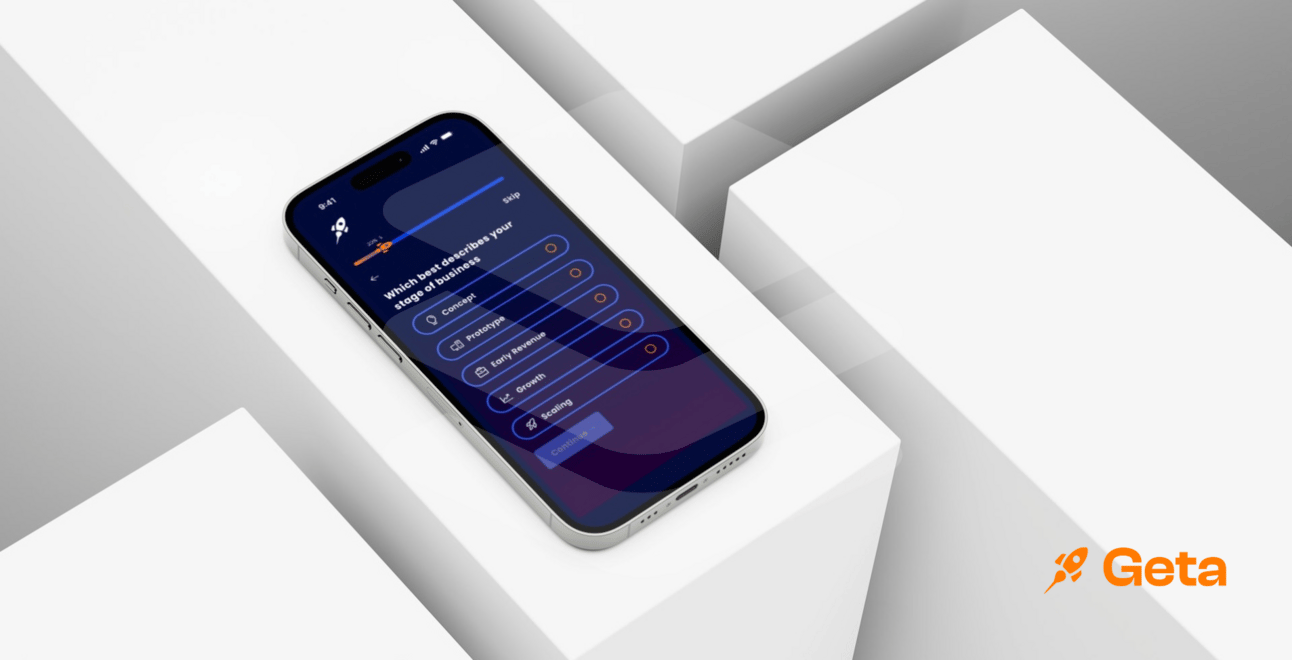

Geta: Your Partner on the Funding Journey

Ultimately, when the time is right, you’ll know what to do. Regardless of your chosen path, Geta empowers you throughout your entrepreneurial journey. Our platform connects founders with a diverse network of investors, both those who appreciate bootstrapped ventures and those seeking high-growth opportunities.